Corporate Governance

KTB continues to enhance the functionality of the Board of Directors, improve the efficiency of the operating team, strive for information transparency, ensure the rights and benefits of shareholders and investors, and build a foundation for sustainable development. From 2018 to 2024, KTB was ranked among the top 5% of TWSE-listed companies in the "Corporate Governance Evaluation" by the Taiwan Stock Exchange Corporation (4th to 10th session) for 7 consecutive years, demonstrating the determination and achievements of KTB in building its corporate governance policy. The number of further study of each director conformed to stipulations in "Key Points for Further Study of Directors and Supervisors from TWSE/GTSM Listed Companies," and relevant achievements in 2024 are as follows:

A Sound Board Structure

KTB's Board of Directors is the supreme governing body of the company, and it now has 7 Directors (not being employees), and 3 Independent Directors which accounts for 43% of all directors. For strengthening the Board's supervisory and management functions, multiple functional committees, including the "Audit Committee," "Remuneration Committee," "Nomination Committee," and "Sustainable Development Committee" are established directly subordinate to the Board of Directors. These committees are responsible for the discussion and resolution of key issues and issues in the economic, social, and environmental aspects. The functional committees consist of or participated by Independent Directors to achieve effective independent supervision and the check and balance mechanism to ensure all resolutions and actions of the Board are submitted to the Board of Directors for report and discussion. In additional, on March 20, 2023, the Board of Directors approved the appointment of Manager Tzu-Yun Chen, who is a qualified lawyer, as the Bank's dedicated Corporate Governance Officer, will handle matters related to board meetings and shareholders' meetings in accordance with the law.

Independence and Interest Recusal

In terms of the Board operation, KTB's Board of Directors carries through the promise of ethical management and has formulated the "King's Town Bank Co., Ltd. Rules of Procedure for Board Meetings," which stipulates in Article 15 that, any motions at the board meetings that pose a conflict of interest with the Director himself/herself or the entity he/she is representing, the Directors shall recuse himself/herself from the discussion and voting on the matters, and he/she must not vote on other Directors' behalf, in accordance with the regulation or in a more rigorous approach. For the implementation status of the directors' recusal of proposal involved in conflicts of interest, please refer to Page 23-25 of King's Town Bank Co., Ltd. 2024 Annual Report. Furthermore, for fulfilling the requirement of independence, the "King’s Town Bank Co., Ltd. Corporate Governance Best-Practice Principles" states the number of seat, qualifications, tenure, functions, and responsibilities of Independent Directors, and explicitly stipulates that the number of independent directors shall not be less than two and shall not be less than 1/3 of total number of directors, and the term of independent directors shall not exceed 3 terms. In addition, KTB has formulated the "Rules Governing the Scope of Powers of Independent Directors" for independent directors to follow to perform their duties well and effectively enhance the operation of the Board of Directors and the Company's operational performance. For the details on the professional qualifications of directors and independence of independent directors, please refer to Page 9 of King's Town Bank Co., Ltd. 2024 Annual Report.

Diverse Board Members

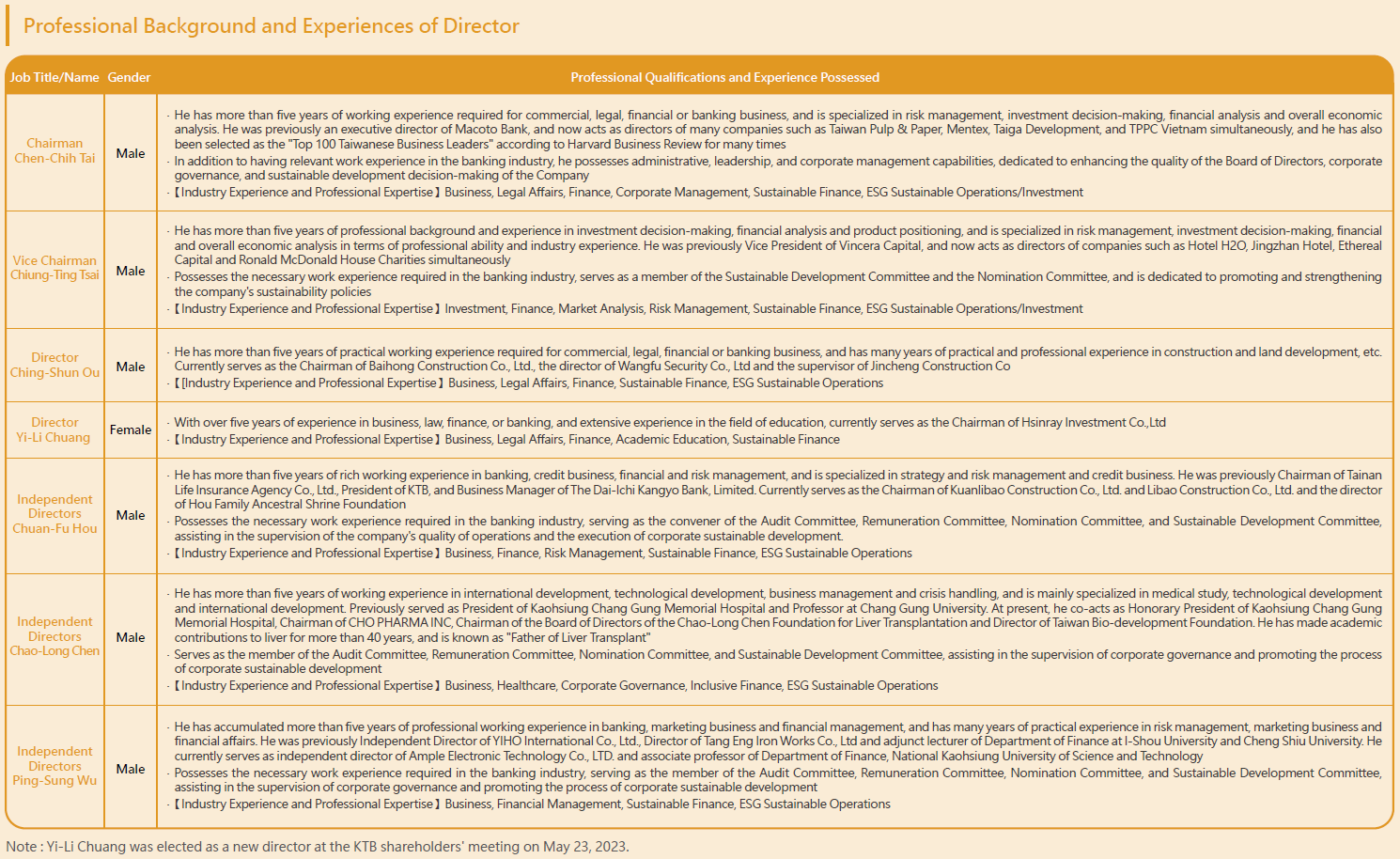

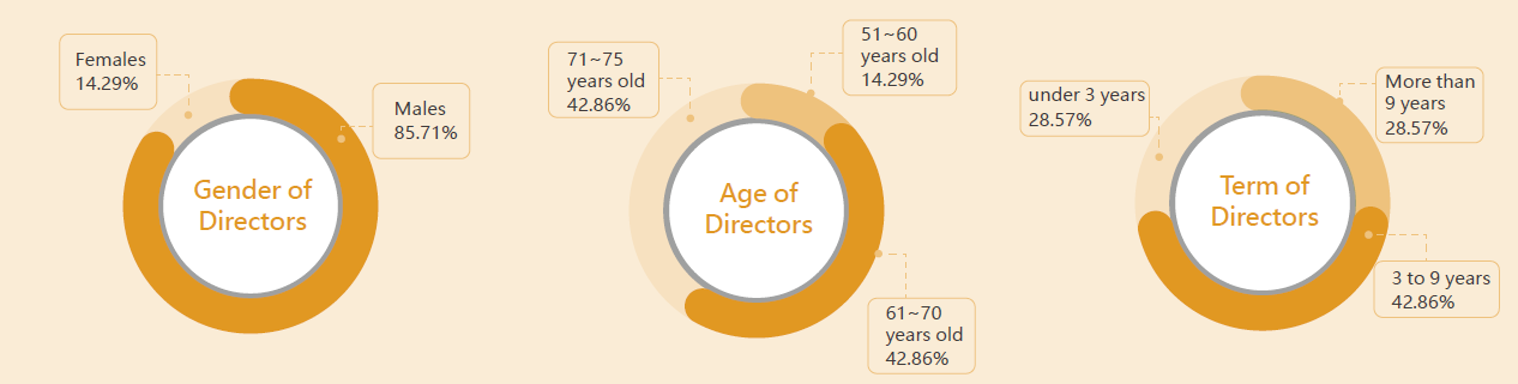

To actively implement the Board of Directors' diversity policy, and give consideration to both specialty and gender balance, KTB states explicitly in the "King’s Town Bank Co., Ltd. Corporate Governance Best-Practice Principles" and "Procedures for the Election of Directors" that constitution of Board members should take a diversity policy into consideration, i.e. their basic conditions (gender, age, nationality, etc.) and professional knowledge and skills (professional background, professional skills and industry experience, etc.) In addition, Article 29 of Corporate Governance Best-Practice Principles explicitly states that "there must be at least one director of each gender." All director candidates shall be nominated by the Nomination Committee by "Candidate Nomination System" in accordance with the Company Act, where, the Sustainable Development and Nomination Committee (separated into two independent functional committees "Sustainable Development Committee" and "Nomination Committee" on June 11, 2024) shall take development strategy of the company and overall functional configuration of the Board of Directors into account, and then submit to the Board of Shareholders for appointment after being passed upon resolution of the Board of Directors. The current Board of Directors of the Company consists of 7 members, including 1 female and 6 male members, all of whom possess extensive academic and professional backgrounds, contributing diverse perspectives to KTB. This diversity further promotes the sustainable development of our enterprise. Implementation of diversity of KTB's Board members is as follows

Continuing Education and Performance Evaluation of the Board of Directors

All the KTB directors complete their continuing education in accordance with the "King's Town Bank Co., Ltd. Directions for the Implementation of Continuing Education for Directors" every year. In 2024, the average duration of training for KTB's Directors was 6.28 hours, meeting the 6 hours as recommended by regulations. The courses include "The principles of fair treatment of customers and corporate integrity management," "The latest development trend of international carbon tariff and the sustainable management strategy of securities and finance industry," "Addressing Global Climate Change Risk: Policy Choices and the Concept of Sustainable Finance (Including Financial Friendliness and CRPD)," "Examining the Benefits of Sustainable Development Goals (SDGs) and ESG Investments from the Perspective of Capital Markets" and so on, and the contents cover corporate governance, regulatory compliance, anti-money laundering, sustainable development, climate-related and other latest topics, so as to enhance their professionality, enhance operation decision-making as well as risk governance function of the Board of Directors by arranging diversified courses.

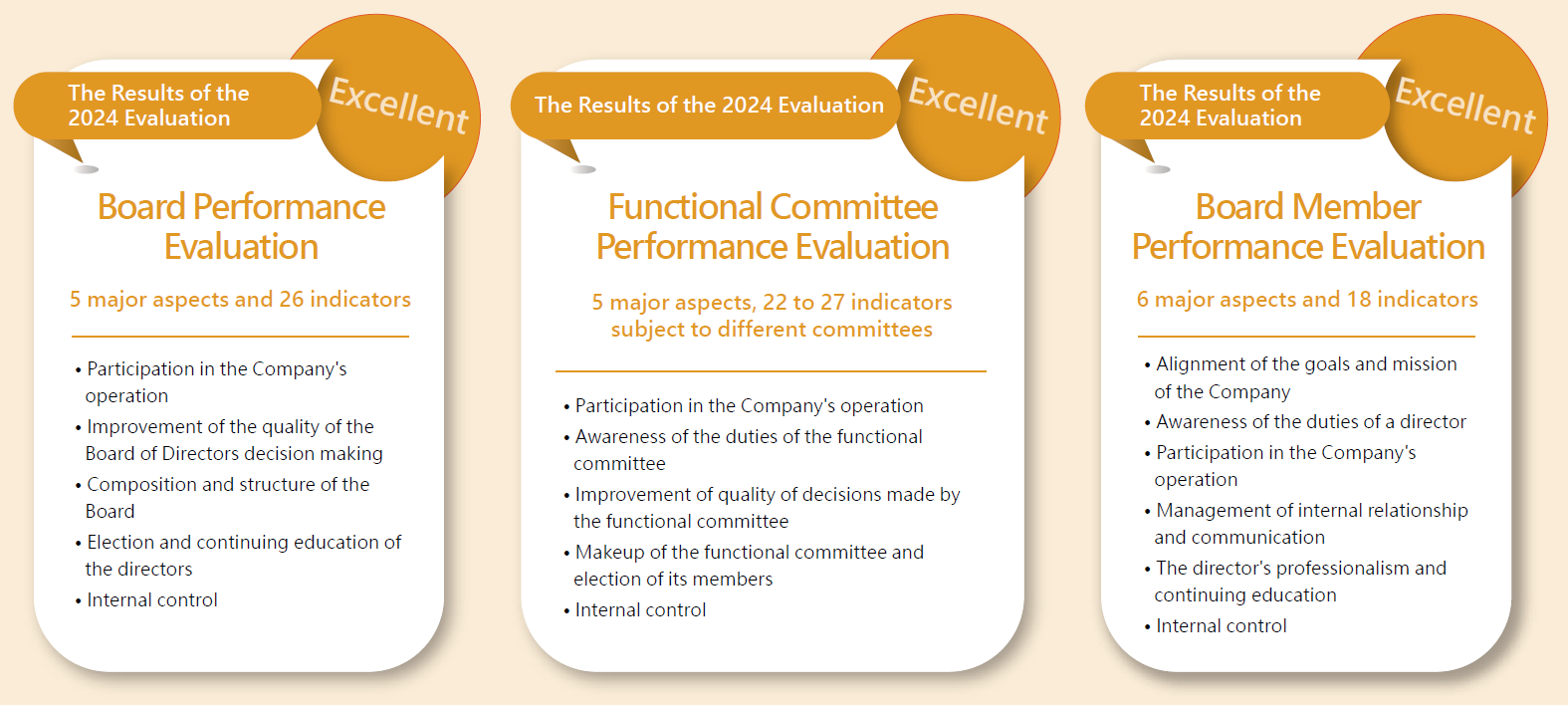

In addition, KTB has formulated the "King's Town Bank Regulations on the Board and the Functional Committee Performance Evaluation." The Nomination Committee carries out annual performance evaluation on the Board and functional committees. The overall performance evaluations of the Board and the functional committees, and the self-evaluation by the Board members are carried out in the first quarter of every year, and the evaluation results are compiled by the Board's meeting organization unit. In addition to review of operation performance, the evaluation contents also cover non-financial projects, such as: improvement of corporate governance, diversity and professionality of Board members, review of risk management system, effectiveness of implementation of sustainable development and other economic, environmental and population impact projects, and report the result to the Board of Directors, to serve as reference for remuneration and successor nomination of individual director. In 2024, performances of the Board of Directors and all functional committees were all evaluated as "Excellent," and the report to Nomination Committee and Board of Directors was made on February 24, 2025. For detailed evaluation contents, please refer to "Results of the Functional Committee Performance Evaluation."

Moreover, the "King's Town Bank Regulations on the Board and the Functional Committee Performance Evaluation" stipulates that the Board performance evaluation shall be conducted by an external professional independent institution or an external professional scholar team every three years. KTB has appointed "Ernst & Young Corporate Management Consulting Services Limited" to carry out the 2024 external board performance evaluation in 2025. According to a comprehensive assessment conducted by Ernst & Young, the Bank achieved a comprehensive performance level of "Advanced" in the areas of board structure and members, while processes and information were rated as "Benchmark." The evaluation summary is as follows:

․ KTB has established functional committees including the Audit Committee, Remuneration Committee, Nomination Committee, and Sustainable Development Committee. The members of the Board of Directors shall possess the necessary knowledge, skills, and competencies required to perform their duties, enabling them to fully utilize their professional expertise and skills.

․ The company has established regulations related to corporate governance, including the "Corporate Governance Best-Practice Principles" and the "Ethical Corporate Management Best Practice Principles." Most directors have a clear understanding of the industry to which the Company belongs, and have effectively assessed and monitored the various existing or potential risks faced by the Company. They have also discussed the implementation and tracking of the internal control system. The internal relationships and operational aspects received positive evaluations, indicating that the board members generally agree that the interaction between the Board of Directors and the management team is good, and there is also effective communication among the directors.

․ It is recommended that the company establish a talent pool for board members through multiple channels to enhance the diversity of board members and enrich the backgrounds of the Board of Directors.

Other relevant information is disclosed on KTB's official website "External Performance Evaluation results of the Board of Directors." The next external performance evaluation is scheduled for the first quarter of 2028.

Remuneration Policy

(1) Director

Remuneration of KTB directors follows stipulations in Article 33 of the Articles of Association: "in case KTB makes profit in the current year, provision for director remuneration not higher than 2% of such profit shall be made, however, if KTB still has accumulated loss, the make-up amount shall be reserved from such profit first." No director remuneration has been provided in recent two years.

In addition, it is provided in Article 25(1) of the Articles of Association that: "remuneration of the directors shall be determined by the Board of Directors by reference to the level of related peers and listed companies." Remuneration of KTB directors is paid by reference to peer level, individual performance of the directors, operational performance of the Company and "Evaluation Results of the Performance of the Board of Directors." In addition, in accordance with Article 5 of "Specification for Scope of Responsibility of Independent Directors," and considering that responsibility and commitment time of independent directors are different from general directors, therefore, reasonable remuneration different from that of general directors is made for independent directors. In addition to fixed remuneration every month, the independent directors do not acquire additional remuneration to directors as stipulated in the Articles of Association, and the business execution expense is determined by reference to the standard for general directors. For remuneration to directors, please refer to "Page 18 of King's Town Bank Co., Ltd. 2024 Annual Report." Relevant performance evaluation and remuneration rationality are examined by the Remuneration Committee and the Board of Directors.

(2) President, Senior Vice President, Chief Auditor, Managerial Officers, and Employee

Performance evaluation and remuneration system regarding the President, Senior Vice President, Chief Auditor, Managerial Officers, and Employee of the Company are handled respectively in accordance with "Regulations on the Annual Employee Performance Evaluation," "Regulations on the Employee Benefit Payment" and "Regulations on the Distribution of Annual Bonus" passed by the Board of Directors. Each year, the Remuneration Committee discusses the compensation and benefits of the Company's senior executives at the Remuneration Committee meeting and submits them to the Board of Directors for approval. The bonus component is linked to the performance assessment of the Company's units.

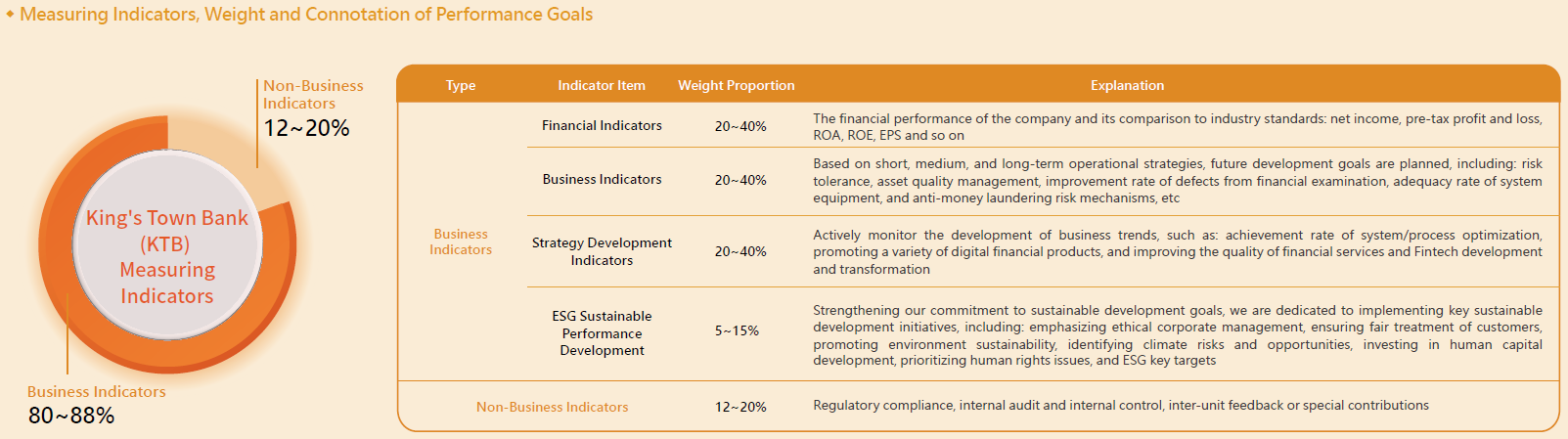

The content of unit performance evaluation is divided into business indicators and non-business indicators, accounting for 80% to 88% and 12% to 20%, respectively. The business indicator items include financial profitability indicators, operational indicators, strategic development indicators, and sustainable development implementation indicators. The content and weight of each indicator are determined according to the responsibilities of each unit. It is stipulated that the weight of the assessment of the implementation of sustainable development in the overall unit of the Bank shall not be less than 5%. This is to integrate the resources of the entire Bank, formulate a unified sustainable development strategy, strengthen the Company's commitment to sustainable development goals, and achieve sustainable development goals. Non-business indicators include regulatory compliance, internal audit and internal controls. While taking into account individual performance, responsibilities and contributions, appropriate compensation is provided so that pay is highly correlated with the Company's operational performance.